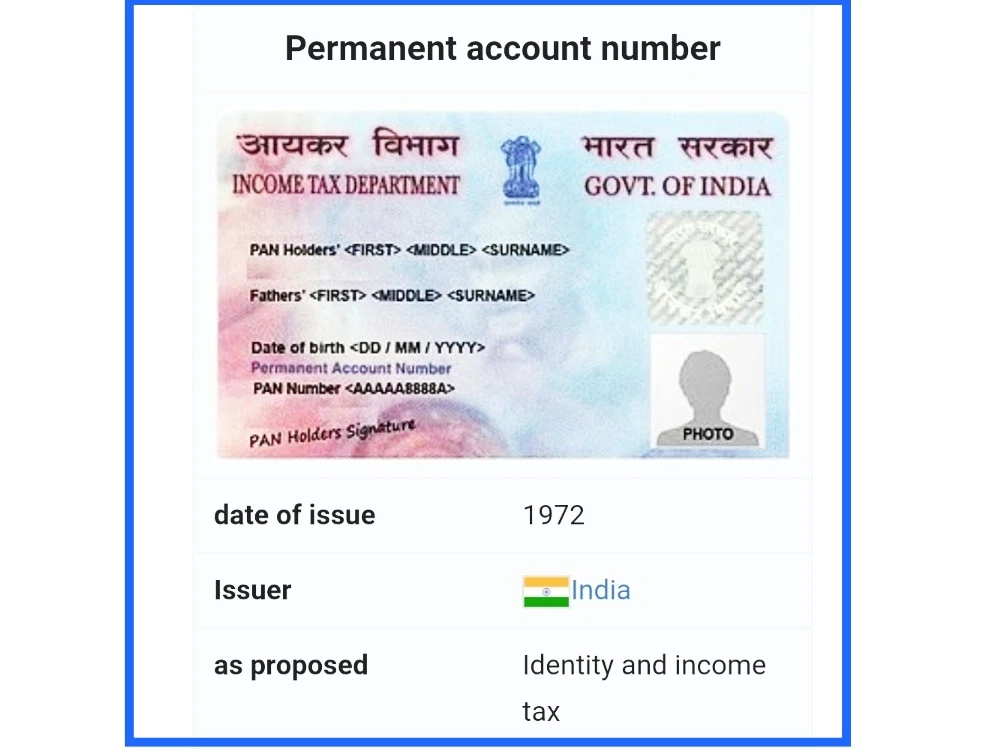

Permanent Account Number or PAN : is a ten digit descriptive number throughout India (eg, ABCD0000J) issued by the Income Tax Department as a laminated card.

It does not change with the address or location change where you are being scheduled. The Income Tax Department has authorized the following for obtaining PAN information: -

(A) Service Ltd. (UTITSL) to set up and manage an IT PAN Service Center in all cities and towns where there is an income tax office and

(B) To provide PAN services from National Securities Depository Limited (NSDL) Tax Information Network (TIN) Facilitation Centers.

Who will apply for PAN Card:

The Income Tax Act provides that every person whose total income is more than the maximum amount which is not taxed or every person who does any business or is engaged in business, whose total income, profit or gross receipts before any Exceeding Rs. 5 lakhs in the previous year or any person who is required to file income statement will apply for PAN.

In addition, any person who does not fulfill the above conditions can also apply for PAN allotment.

With effect from 1.6.2000, the Central Government shall by notification specify any class or category of persons, including the importer and exporter, whether any tax is paid by them or otherwise, that person may also apply for PAN allotment to the Assessing Officer.

From 1.4.2006, PAN has also been allotted for the person who is responsible to file the return for the benefits. He does not need to get another PAN.

Since the income of a financial year is taxed in a subsequent year called the assessment year, an application for PAN should be made before 30th June of the respective assessment year.

How to apply for PAN Card:

Application for allotment of PAN is to be made in Form 49A. While filling this form, the following things have to be kept in mind: -

- The application form is typed or handwritten, it should be in capital letters in black ink

- Two black and white photos to be attached

- When the address for the contact is selected, special attention is given that the contact will then be sent to the specified address.

- Only the father's name should be given in the space provided for 'Father's name'. Married woman should take care of the name of the husband and not be given.

- Special attention should be paid to filling the correct date of birth.

- The form should be signed in English or in two specific places in any Indian language. Attestation by the gazetted officer is mandatory in the case of thumb printing.

Transactions where it is mandatory to mention PAN Card:

- Real estate purchase and sale

- Buying and selling of motor vehicles

- Transaction in more than 50,000 shares

- New bank account opening

- Fixed deposit above Rs 50,000

- Application for allotment of telephone connection

- Payment to hotels over Rs 25,000

- Provided that by the time the PAN is allotted to the person, he may indicate his general index registration number or GIR number,

- To apply for a credit or debit card to any banking company,

- To open a demat account,

- In a financial year of LIC premium Rs. Over 50,000 payments,

- If the sale / purchase of unlisted shares by a person is more than 1 lakh per transaction.

Notice of changes:

The following changes should be reported to the Assessing Officer

- Death of assessee

- Trade off

- Breach of firm

- Division of Hindu Undivided Family (HUF)

- Winding up or closing a company

- Merger, conference or acquisition of company

Application for new PAN under the new series:

- The application for new PAN under the new series can be made under the following circumstances

- Division of undivided Hindu family (HUF) into one or more undivided families

- New undivided Hindu family (HUF) comes into existence

- Changes in the constitution of the firm (change in partners)

- Existing company split into two or more companies

Now you should help us a bit

So friends, how did you like our post! Don't forget to share this with your friends, below Sharing Button Post. Apart from this, if there is any problem in the middle, then don't hesitate to ask in the Comment box. If you want, you can send your question to our email Personal Contact Form as well. We will be happy to assist you. We will keep writing more posts related to this. So do not forget to bookmark (Ctrl + D) our blog “www.variousinfo.co.in” on your mobile or computer and subscribe us now to get all posts in your email. If you like this post, then do not forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like whatsapp, Facebook or Twitter. Thank you !

If you liked the information of this article, then please share your experience by commenting. This is very helpful for us and other readers. Thank you